How to Check if a Car Has Outstanding Loans Before Buying in Dubai

Buying a used car in Dubai can be a great way to save money, but it comes with certain risks. One of the biggest risks is the possibility of an outstanding loan on the vehicle. Many cars in Dubai are purchased through financing, and if a seller has not fully repaid the loan, the car technically still belongs to the bank or lending institution.

Checking a car’s financial status before purchasing could lead to serious problems. If the loan is still active, you may not be able to register the car in your name until the debt is cleared. In some cases, you might even be held responsible for the remaining payments. To avoid these risks, it is crucial to verify whether a car has any outstanding loans before finalizing the purchase.

In this blog, we at Drive UAE explore the steps you can take to check a vehicle’s financial status in Dubai, ensuring a safe and hassle-free buying experience.

Understanding Vehicle Financing and Its Implications

Vehicle financing is a common way for people to buy cars in Dubai without paying the full amount upfront. Instead, they take out a loan from a bank or a financing company and repay it in monthly installments. Until the loan is fully repaid, the lender holds legal ownership of the vehicle.

There are two main types of car financing in Dubai:

- Bank Loans: The buyer borrows money from a bank and repays it in fixed monthly payments. The bank keeps a mortgage on the car until the loan is fully paid.

- Dealer or In-House Financing: Some car dealerships offer financing plans where buyers pay in installments directly to the dealership. These plans usually come with specific conditions set by the dealer.

What Happens If a Car Has an Outstanding Loan?

If a car still has a loan attached to it, it legally belongs to the lender, not the seller. This means that if you buy the car without clearing the loan, you could face several issues:

- Registration Problems: The Roads and Transport Authority (RTA) in Dubai does not allow the transfer of ownership if the car has an active loan.

- Financial Liability: If the previous owner fails to pay off the loan, the lender may demand the remaining amount from you.

- Legal Consequences: In extreme cases, the lender could reclaim the car, leaving you without both the vehicle and your money.

Steps to Verify Outstanding Loans on a Vehicle in Dubai

Before buying a used car in Dubai, it is essential to confirm that it is free from any outstanding loans. Several official methods can help you check a vehicle’s financial status.

Below are the key steps to ensure a safe and secure purchase.

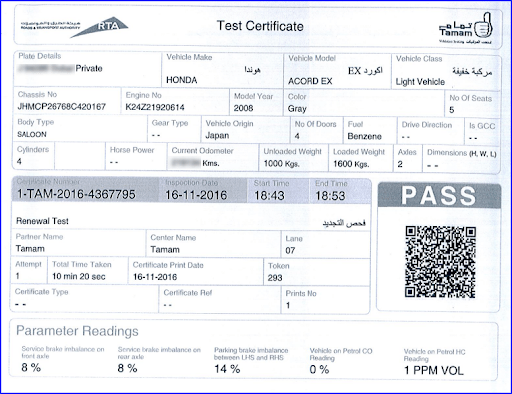

Review the Mulkiya (Vehicle Registration Card)

The Mulkiya, or Vehicle Registration Card, is an official document issued by the Roads and Transport Authority (RTA) in Dubai. It contains crucial information about the car, including its registration details, chassis number, and ownership status.

How to Check for Loans on the Mulkiya

- If a car has an active loan, the Mulkiya may have a note indicating a mortgage in favor of a bank or lender.

- Look for any bank or financial institution’s name mentioned in the document.

- If the Mulkiya does not show any loan-related details, it is still recommended to verify through official platforms.

Utilize the RTA Vehicle Status Certificate

The RTA Vehicle Status Certificate is a reliable way to check a car’s financial and legal status before purchase. This certificate provides details about any active loans, fines, or other legal restrictions linked to the vehicle.

How to Obtain the RTA Vehicle Status Certificate

- Visit the RTA website (www.rta.ae) or use the RTA Dubai mobile app.

- Select the option for the Vehicle Status Certificate service.

- Enter the car’s details, including the chassis number or plate number.

- Pay the required fee (approximately AED 100–150).

- Receive the certificate, which will indicate whether the car has an outstanding loan or any other issues.

This step provides an official confirmation of the vehicle’s financial and legal standing before making a purchase.

Consult the Emirates Vehicle Gate (EVG) Platform

The Emirates Vehicle Gate (EVG) is an online portal that provides comprehensive details about a vehicle, including its mortgage status.

How to Check a Car’s Loan Status on EVG

- Visit the EVG website.

- Log in using your Emirates ID or vehicle details.

- Navigate to the vehicle mortgage status section.

- Enter the chassis number or registration details of the car.

- View the results to check if the car has any active loans.

This platform provides up-to-date and accurate financial details about the vehicle, making it a useful tool for buyers.

Engage with the Seller’s Financing Institution

If the car is under a loan, the financing bank or institution must issue a No Objection Certificate (NOC) before the sale can proceed.

How to Ensure the Loan is Settled

- Ask the seller to contact their bank or lender and request a loan clearance certificate.

- Ensure that the bank removes the mortgage from the vehicle in the RTA system.

- If the seller has not fully paid off the loan, you can agree to settle the loan first before completing the purchase.

Only after the loan is cleared and the mortgage is removed should you proceed with transferring ownership.

Conclusion

Verifying a car’s financial status before buying is essential to avoid unexpected financial and legal issues. By checking the Mulkiya, using the RTA Vehicle Status Certificate, consulting the EVG platform, and ensuring the financing institution clears the loan, you can confidently purchase a used car in Dubai without worrying about hidden debts.