Factors That Affect Used Car Insurance in Dubai & How to Get the Best Deal

Car insurance is essential for every vehicle owner in Dubai, offering financial protection against accidents, theft, and unexpected damages. However, when it comes to insuring a used luxury or sports car, the costs and coverage options can vary significantly. Understanding what factors influence insurance premiums can help car owners make informed decisions and avoid overpaying.

In this blog, Drive UAE will explore the key factors that affect used car insurance in Dubai.

Factors Influencing Used Car Insurance in Dubai

When insuring a used car in Dubai, several factors determine the cost. Understanding these factors can help you choose the right coverage and manage costs effectively.

Vehicle-Specific Factors

Older cars generally have a lower market value, which might reduce insurance costs. However, they may also be more prone to mechanical issues, leading to higher premiums in some cases.

Luxury and sports cars often come with higher insurance costs because they have expensive parts, advanced technology, and a higher risk of theft.

A car with a clean service record and no past accidents is considered less risky to insure, which can result in lower premiums.

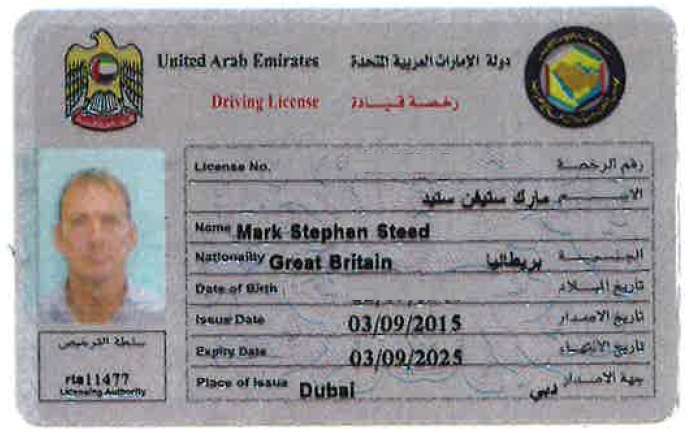

Driver-Related Factors

Insurance companies assess your past driving record. If you have a history of safe driving with no accidents or violations, you are likely to get a lower insurance rate.

Some demographics are considered higher risk than others. Younger or inexperienced drivers may face higher premiums compared to older, more experienced drivers.

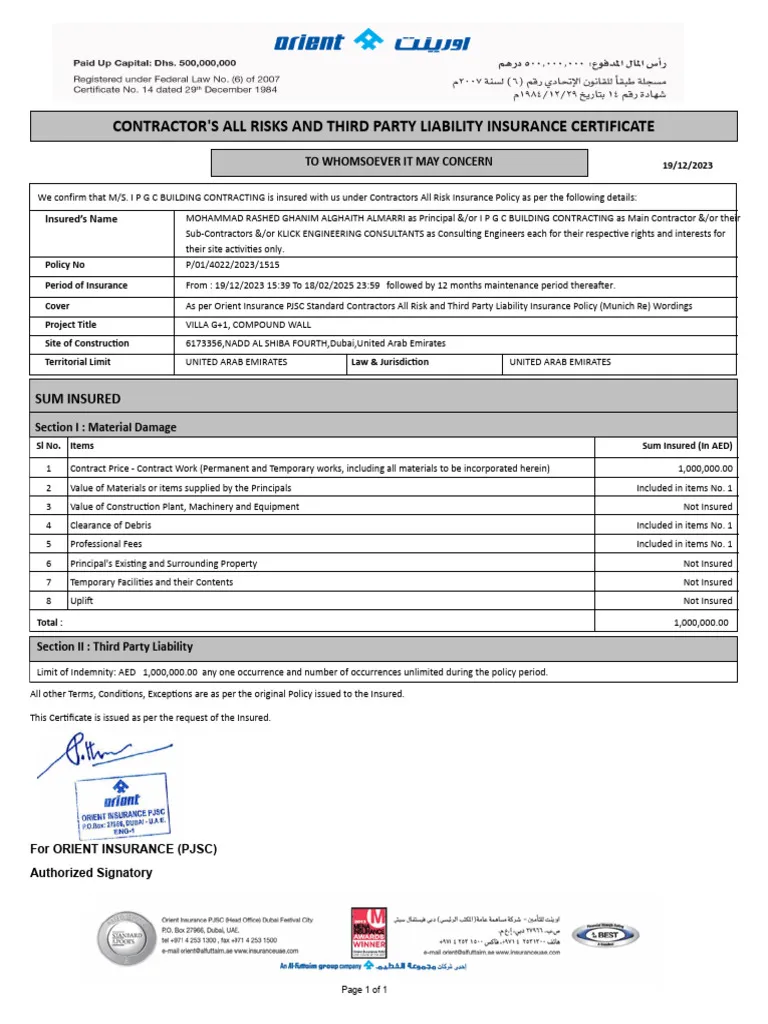

Policy-Related Factors

Comprehensive insurance offers full protection against accidents, theft, and other damages, but it comes at a higher price. Third-party liability insurance is more affordable but provides limited coverage.

A higher deductible (the amount you pay out of pocket before the insurance covers the rest) can reduce your premium, but it also means you will need to pay more if you make a claim.

External Factors

If you live in an area with high accident rates or a high risk of car theft, your insurance premium may be higher. How you use your car also affects your insurance. If you drive long distances daily, your risk of accidents increases, which can lead to a higher premium. On the other hand, cars used occasionally may have lower insurance costs.

Strategies to Secure the Best Insurance Deals for Used Cars in Dubai

Finding the best insurance deal for a used car in Dubai requires careful planning and research. Here are some effective strategies to help you save money while ensuring proper coverage:

1. Compare Multiple Quotes

Insurance rates can vary between providers, so it’s important to compare different options before making a decision. Use online comparison tools or consult multiple insurance companies to find the best price for the coverage you need.

2. Maintain a Clean Driving Record

A history of safe driving with no accidents or traffic violations can significantly lower your insurance premium. Insurers offer discounts to drivers with a good track record since they are considered lower risk.

3. Choose the Right Coverage

Evaluate whether you need comprehensive insurance or third-party liability coverage. If your car is older and has a lower market value, a third-party policy may be a more cost-effective option. However, if the vehicle is high-value, comprehensive coverage is recommended.

4. Increase Your Deductibles

A higher deductible means you will pay more out of pocket if you file a claim, but it also reduces your monthly premium. If you are a safe driver and rarely make claims, this can be a good way to lower costs.

5. Take Advantage of Discounts

Many insurers offer discounts for various reasons, such as no-claims bonuses, multiple-policy bundling, and installing safety features like anti-theft devices. Always ask your provider about available discounts.

6. Install Security Features

Adding anti-theft systems, GPS trackers, and other safety features to your car can lower the risk of theft and reduce insurance costs. Insurance companies may offer discounts for vehicles with enhanced security.

7. Choose Annual Payments Instead of Monthly Installments

Paying your premium in one lump sum instead of monthly installments can sometimes get you a discount, as many insurers charge extra fees for monthly payments.

9. Regularly Review and Update Your Policy

Insurance needs to change over time. If your car’s market value decreases, you may be able to switch to a more affordable policy. Reviewing your coverage regularly ensures you are not overpaying for insurance.

By following these strategies, you can get the best insurance deal for your used car in Dubai, ensuring you are well-protected while keeping costs under control.

Conclusion

Understanding the factors that affect used car insurance in Dubai can help you make informed decisions and avoid overpaying. Vehicle characteristics, driver history, policy choices, and external factors all play a role in determining your premium.

By comparing multiple quotes, maintaining a clean driving record, choosing the right coverage, and taking advantage of discounts, you can secure the best insurance deal without compromising on protection.